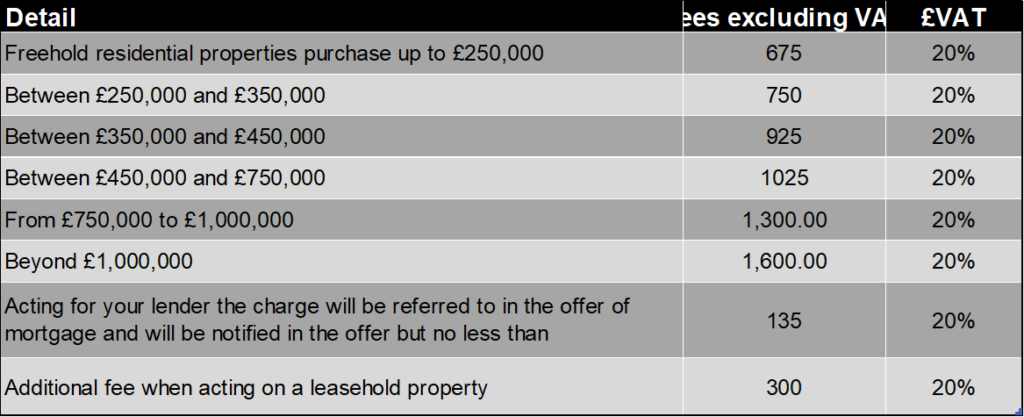

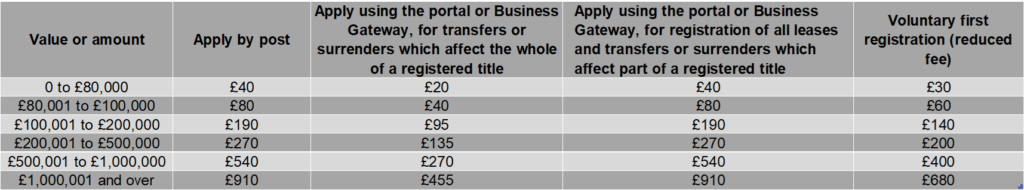

What other fees could be incurred at Glanvilles

Our fees are fixed, however, there may be factors which would typically increase the cost of matter.

Where this is likely to be an additional cost we will make sure we inform you at the earliest opportunity and an estimate of those extra costs will be provided. To give you more information on guideline fees for additional work, please see the list of additional fees below. Whilst these fees are not exhaustive, we hope this gives you an idea of what else may be reasonably charged for.

Assumptions

It is only right to advise that our fee assumes that:-

- The matter will be a standard residential conveyancing and no unforeseen matters arise, including but not limited to a defect in the title which requires remedying prior to completion or preparation of additional documents ancillary to the main transaction.

- The transaction is concluded in a timely manner and no unforeseen complication arises.

- All parties to the transaction are cooperative and there is no unreasonable delay in third parties providing documentation or services.

- Once instructed, your instructions to us do not change in a material way. An example of a material change would be that you instruct us that you are buying a property in your sole name but, after we are instructed, you decide to purchase the property jointly with a spouse or some other person.

Exclusions

We do not undertake tax advice, with the exception of reporting and paying the stamp duty on a property transaction.

Our fees are fixed, however there may be factors which would typically increase the cost of the fees estimated above. Where there is likely to be any additional cost, we will make sure you are informed of this at the earliest opportunity and a clear estimate of those extra costs will be provided.

Factors that may lead to an increase in cost include:

- If a legal title is defective or part of the property is unregistered

- If you discover building regulations or planning permission has not been obtained

- If crucial documents, we have previously requested from you have not been provided to us

- If the property is a new build

- If any of the additional items set out above are required

Timescales

On any transaction, the timescales are subject to change depending on many many factors such as mortgage offers, searches, parties within the chain and so on. The average transaction takes between eight to ten weeks. It can be slower or quicker, and the following situations may give you an idea of timing scenario’s :-

- For a first time buyer purchasing a brand new property with a mortgage in principle it could take 8 weeks if the property is ready for occupation.

- If you are buying a leasehold property that requires an extension to the Lease and raising enquiries from the Landlord or another third party, it can take significantly longer and between 10 – 16 weeks.

- If you are buying and selling a property and there is a chain of say three or four requiring mortgages and searches, this may typically take between 8 – 12 weeks.

- The average mortgage takes between five and six weeks to be issued from the date of application.

- Local Authority searches and enquiries on a purchase can take around five weeks.

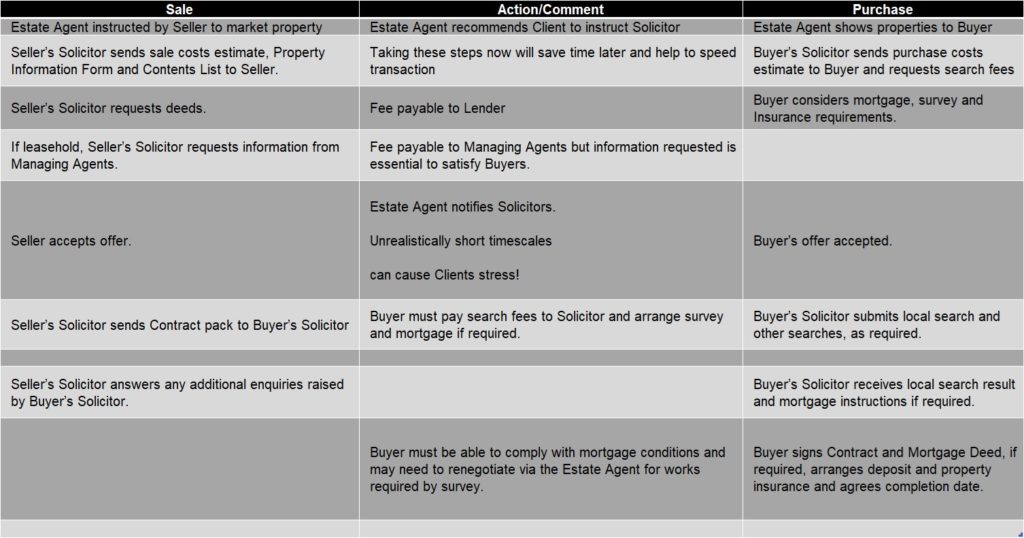

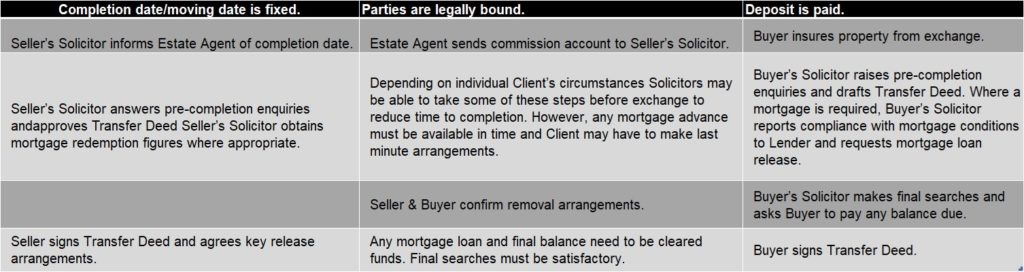

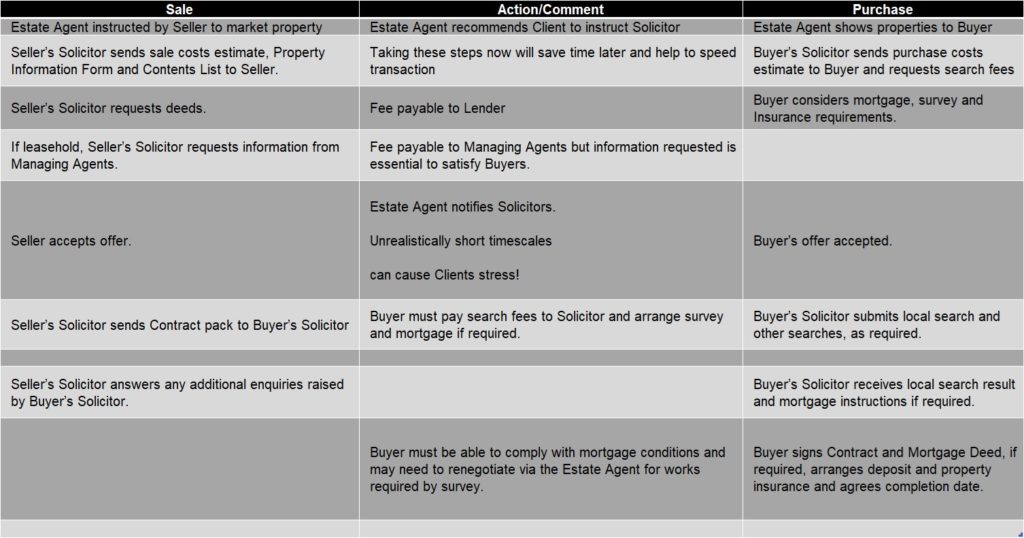

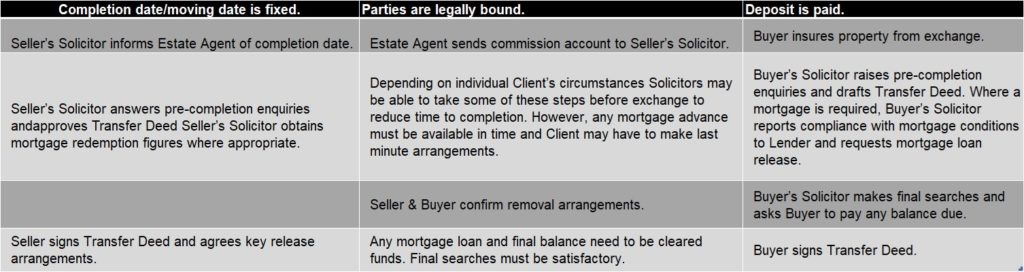

Below are the key stages of a sale/purchase matter which we hope to prove useful.